After a couple of blown accounts and very few wins, Im back to the drawing board with trying to figure out my edge in trading. I’ll continue to watch videos and learn as much as I can. Right now, Im in research mode, only trading on my Paper Account. Im looking at adopting a few strategies, as the market tends to change, like all the time.

My first strategy is to DCA (Dollar Cost Average). I saw a guy showing how he trades and wins by just randomly picking buy or sell, and then “doubling down” when it turns the other way on him. Seems like a good approach, but I’ll have to test my own levels to see if that will be viable in a Prop Firm account. Since Prop Firms have draw downs and daily draw downs, I’ll need to find one that allows multiple contracts to trade, as going into a long “double down” can take 5 to 10 contracts to turn around. Below are some examples of what happened today with that.

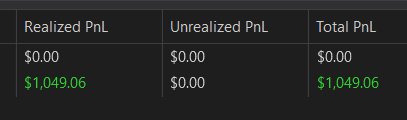

I am also practicing Limit orders. I’m seeing a strategy that allows me to enter a trade using “chess tactics”. After blowing several trades, I realized that I need to stop chasing the market, and start predicting (the best I can) where the market will be in 5 or 10 minutes from now. Below is a trade where I setup a Limit order at the top resistance level. After that filled, I set an exit Market fill order, but also set a “double down” order in case it turns on me. In doing that, Im “hedging” that I’ll win either way. One just make take longer than the other. Funny thing happened on this one. I was kinda disappointed that I won the trade so quickly.

I’ll be staying the drawing board for awhile. Once I figure out my edge and get some rules to live by and a sturdy risk management, I’ll find another Prop Firm to work in. Much better to play with other peoples money.